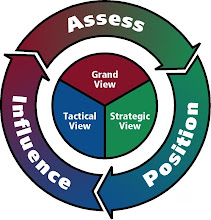

China's solar energy businesses assessed the grand settings of their global market terrain in terms of their competitive position, the state of predictability and the configuration of the terrain, the Compass for their strategy was defined.

The advantage of lower operating costs enabled China to gain the control of the marketplace. Their immediate momentum and the timing also allowed them to advance deeply into their competitor's territory and became the bellwether of the market-place. ...

Once China assessed their grand picture. They positioned themselves with a complete top down strategy and implemented with extreme efficiency.

This is a good example of what the "Dao of Competition" (warfare) is supposed to be.

#

August 25, 2009

China Racing Ahead of U.S. in the Drive to Go Solar

By KEITH BRADSHER

WUXI, China — President Obama wants to make the United States “the world’s leading exporter of renewable energy,” but in his seven months in office, it is China that has stepped on the gas in an effort to become the dominant player in green energy — especially in solar power, and even in the United States.

Chinese companies have already played a leading role in pushing down the price of solar panels by almost half over the last year. Shi Zhengrong, the chief executive and founder of China’s biggest solar panel manufacturer, Suntech Power Holdings, said in an interview here that Suntech, to build market share, is selling solar panels on the American market for less than the cost of the materials, assembly and shipping.

Backed by lavish government support, the Chinese are preparing to build plants to assemble their products in the United States to bypass protectionist legislation. As Japanese automakers did decades ago, Chinese solar companies are encouraging their United States executives to join industry trade groups to tamp down anti-Chinese sentiment before it takes root.

The Obama administration is determined to help the American industry. The energy and Treasury departments announced this month that they would give $2.3 billion in tax credits to clean energy equipment manufacturers. But even in the solar industry, many worry that Western companies may have fragile prospects when competing with Chinese companies that have cheap loans, electricity and labor, paying recent college graduates in engineering $7,000 a year.

“I don’t see Europe or the United States becoming major producers of solar products — they’ll be consumers,” said Thomas M. Zarrella, the chief executive of GT Solar International, a company in Merrimack, N.H., that sells specialized factory equipment to solar panel makers around the world.

Since March, Chinese governments at the national, provincial and even local level have been competing with one another to offer solar companies ever more generous subsidies, including free land, and cash for research and development. State-owned banks are flooding the industry with loans at considerably lower interest rates than available in Europe or the United States.

Suntech, based here in Wuxi, is on track this year to pass Q-Cells of Germany, to become the world’s second-largest supplier of photovoltaic cells, which would put it behind only First Solar in Tempe, Ariz.

Hot on Suntech’s heels is a growing list of Chinese corporations backed by entrepreneurs, local governments and even the Chinese military, all seeking to capitalize on an industry deemed crucial by China’s top leadership.

Dr. Shi pointed out that other governments, including in the United States, also assist clean energy industries, including with factory construction incentives.

China’s commitment to solar energy is unlikely to make a difference soon to global warming. China’s energy consumption is growing faster than any other country’s, though the United States consumes more today. Beijing’s aim is to generate 20,000 megawatts of solar energy by 2020 — or less than half the capacity of coal-fired power plants that are built in China each year.

Solar energy remains far more expensive to generate than energy from coal, oil, natural gas or even wind. But in addition to heavy Chinese investment and low Chinese costs, the global economic downturn and a decline in European subsidies to buy panels have lowered prices.

The American economic stimulus plan requires any project receiving money to use steel and other construction materials, including solar panels, from countries that have signed the World Trade Organization’s agreement on free trade in government procurement. China has not.

In response to this, and to reduce shipping costs, Suntech plans to announce in the next month or two that it will build a solar panel assembly plant in the United States, said Steven Chan, its president for global sales and marketing.

“It’ll be to facilitate sales — ‘buy American’ and things like that,” Mr. Chan said, adding that the factory would have 75 to 150 workers and be located in Phoenix, or somewhere in Texas.

But 90 percent of the workers at the $30 million factory will be blue-collar laborers, welding together panels from solar wafers made in China, Dr. Shi said.

Yingli Solar, another large Chinese manufacturer, said on Thursday that it also had a “preliminary plan” to assemble panels in the United States.

Western rivals, meanwhile, are struggling. Q-Cells of Germany announced last week that it would lay off 500 of its 2,600 employees because of declining sales. It and two other German companies, Conergy and SolarWorld, are particularly indignant that German subsidies were the main source of demand for solar panels until recently.

“Politicians might ask whether this is still the right way to do this, German taxpayers paying for Asian products,” said Markus Wieser, a Q-Cells spokesman.

But organizing resistance to Chinese exports could be difficult, particularly as Chinese discounting makes green energy more affordable.

Even with Suntech acknowledging that it sells below the marginal cost of producing each additional solar panel — that is, the cost after administrative and development costs are subtracted — any antidumping case, in the United States, for example, would have to show that American companies were losing money as a result.

First Solar — the solar leader, in Tempe — using a different technology from many solar panel manufacturers, is actually profitable, while the new tax credits now becoming available may help other companies.

Even organizing a united American response to Chinese exports could be difficult. Suntech has encouraged executives at its United States operations to take the top posts at the two main American industry groups, partly to make sure that these groups do not rally opposition to imports, Dr. Shi said.

The efforts of Detroit automakers to win protection from Japanese competition in the 1980s were weakened by the presence of Honda in their main trade group; they expelled Honda in 1992.

Some analysts are less pessimistic about the prospects for solar panel manufacturers in the West. Joonki Song, a partner at Photon Consulting in Boston, said that while large Chinese solar panel manufacturers are gaining market share, smaller ones have been struggling.

Mr. Zarrella of GT Solar said that Western providers of factory equipment for solar panel manufacturers would remain competitive, and Dr. Shi said that German equipment providers “have made a lot of money, tons of money.”

The Chinese government is requiring that 80 percent of the equipment for China’s first municipal power plant to use solar energy, to be built in Dunhuang in northwestern China next year, be made in China.

Dr. Shi said his company would try to prevent similar rules in any future projects. The reason is clear: almost 98 percent of Suntech’s production goes overseas.

Copyright 2009 The New York Times Company

http://www.nytimes.com/2009/08/25/business/energy-environment/25solar.html

1 comment:

There is a chance you are qualified for a new government solar energy program.

Click here to find out if you're eligble now!

Post a Comment