Behind every hero is a support team that collaboratively supports him or her.

If you are running a small-medium sized company, how do you get your company competitively ready to contend with your larger competitors? Quietly, you hope that your team are collaborating well as a team.

Behind every hero is a support team that collaboratively supports

him or her.

If you are running a small-medium sized company, how do you get your company competitively ready to contend with your larger competitors? Quietly, you hope that your team are collaborating

well as a team.

My questions to you are:

Does your company possess the same resource capacity and manpower as your competitors?

If your team fails as a team, can you survive the failure like a larger company would?

Is your company using the same team collaborative process as your competitor?

What team collaborative advantage does your company have?

Is your project team collaboratively moving as a team?

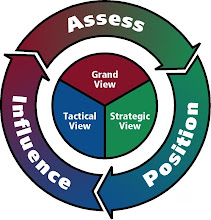

When they collaborate, do they see the big picture of how everything connects?

Is your company moving as one single entity?

If not, ask yourself the question "Will your company survive in the next three years?"

Does your project team hold the key to the success of your company?

Does your project team need a Compass to collaboratively understand what direction they are focusing on?

# # #

September 30, 2007

Ping

The Unsung Heroes Who Move Products Forward

By G. PASCAL ZACHARY

AT first blush, the iPhone from Apple, the new microprocessor family from Intel and the ubiquitous Google search engine have nothing in common. One is a gadget, one is an electronic part and one is a service.

Yet all of these products much acclaimed for their creativity depend on obscure process innovations that, while highly complex and lacking glamour, are an essential part of establishing a winning edge in commercial electronics. Indeed, the success of Apple, Intel, Google and scores of other technology companies has as much or more to do with their process innovations as the products that inspire loyalty among fans and admiration from foes.

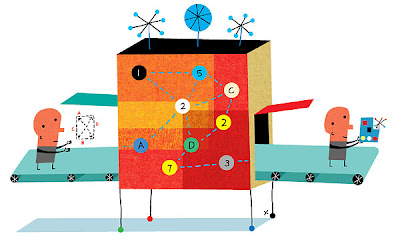

First, a definitional detour. Processes are the stuff in the proverbial black box, the alchemy unseen by consumers or the inelegantly termed end users who buy computers, cellphones, cameras and all manner of digital devices and services.

Snazzy products are the stuff of legends, romanticized by early adopters and skewered by neo-Luddites. Yet while these products bring glory to companies, novel processes are often more important in keeping the cash registers ringing.

The proof of this proposition is that while companies often spend millions to advertise and market new product designs and innovations, they guard intensely the details of their process innovations.

Consider the question of Google’s greatest business secret. Is it the algorithms behind its search tools? Or is it the way it organizes vast clusters of computers around the globe to answer queries so quickly? Perhaps predictably, Google won’t disclose the number of computers deployed in its vast information network (though outsiders speculate that the network has at least 450,000 computers).

I believe that the physical network is Google’s secret sauce, its premier competitive advantage. While a brilliant lone wolf can conceive of a dazzling algorithm, only a superwealthy and well-managed organization can run what is arguably the most valuable computer network on the planet. Without the computer network, Google is nothing.

Eric E. Schmidt, Google’s chief executive, appears to agree. Last year he declared, We believe we get tremendous competitive advantage by essentially building our own infrastructures.

Process innovations like Google’s computer network are often invisible to the public, and impossible to duplicate by rivals. Yet successful companies realize that maintaining competitive advantage depends heavily on sustaining process innovations. Great process innovators often support basic research in relevant fields, maintain complete control over the creation of every aspect of a product and refuse to rely on outside suppliers for important components. Certainly, there are exceptions to these patterns, but even companies like Apple that buy essential processes on the open market nevertheless invest in gaining a working knowledge of the technologies and an understanding of their future arc.

Intel treats its process innovations as a competitive weapon, striving to create a new generation every two years. That enables the company’s chips, even if there were no changes in their design, to perform better and cost less to make.

Consumers are usually blind to the importance of novel processes. Even when they learn about these innovations, they tend to think only of the product itself.

The average consumer doesn’t care what processes are used, says Mark T. Bohr, an Intel physicist who oversaw what is arguably the most important advance in decades in the technology for making microprocessors, the brains inside computers and other digital devices.

Faced with ever-faster chips that threatened to explode into flames, Intel searched desperately for new processes to make microprocessors. Enter hafnium, a rare metal. Designers led by Mr. Bohr in Hillsboro, Ore., chose hafnium to replace silicon oxide, the venerable insulator in chips and a material used in making glass. Mr. Bohr also helped to identify new materials, whose identity Intel is keeping secret, for the crucial transistor gates that sit atop a chip’s insulators.

On Nov. 12, Intel will begin shipping its first chips using the new processes. Gordon E. Moore, Intel’s co-founder, recently declared that the hafnium-and-gate process innovations should allow his so-called Moore’s Law, whereby chips grow ever faster and less expensive, to hold true for some time.

Despite the enormity of the achievement, Mr. Bohr is relatively anonymous, even within Intel. The work of process development comes second to creating new designs for chips, he says. Not surprisingly, when Intel starts shipping the new chips, neither the hafnium nor the gates innovations will be trumpeted as selling points. Rather, Intel will emphasize how customers can benefit from using the chips.

If process innovations are unheralded, consumers may misunderstand the nature of technological change.

Process innovation tends to receive less attention from the informed public for the same reason that incremental innovation tends to receive too little attention: it is more difficult to encapsulate in a press release or photo opportunity, says David C. Mowery, a business professor at the University of California, Berkeley, and a scholar of technological change.

Process innovation, even more than most product innovations, also tends to realize its economic potential through a lengthy process of incremental improvement based on learning by doing and other types of learning, he added. So ‘breakthroughs’ in process engineering are, if anything, even rarer than in product innovation.

As a result, process gurus are resigned to playing in the shadows, leaving fame, if not fortune, to others. John Feland, human interface architect at Synaptics Inc. in Santa Clara, Calif., knows this enduring truth of invention. He helps design arrays of sensors that drive the touch screens in the newest cellphones like the Prada from LG. Such touch screens are earning raves from consumers, yet Mr. Feland is essentially an invisible man.

My job is to make our customers look like heroes, he says philosophically. Then he sums up the special role played by fellow members of the process tribe: We are like Q to James Bond.

G. Pascal Zachary teaches journalism at Stanford and writes about technology and economic development. E-mail: gzach@nytimes.com.

Copyright 2007 The New York Times Company

http://www.nytimes.com/2007/09/30/technology/30ping.html

# # #