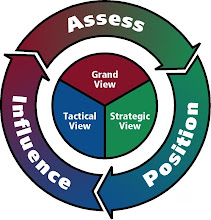

In unpredictable times, it is important to be flexible. With the objective of creating predictability within one's settings, one focuses on being efficient in the reduction of chaos.

The first step is assessing the grand settings. The assessment stage must contain everything in terms of details regarding to the competitive position of each competitor, their strategic advantage, the weakness and strength, etc. The succeeding step of the assessment process is connecting the strategic positioning to the following: the cycles, the opportunities, the terrains, the situations, and the contingencies.

The next stage is developing a Tangible Vision (a strategic overview) with a few PACE guidelines that based on the strategic assessment. The Tangible Vision provides a top down view of the grand picture.

Detail wise, the Tangible Vision must also contain the prioritization of strategic value points and what one is willing to trade off. If the specifics of the Tangible Vision do not have anything regarding to "mission", "commitment", "consequences"; "impact"; "reliability"; and "tangibility". I would bet against it.

During the extreme state of unpredictability, one might decide to sacrifice one strategic value point in order to complete their goal. No strategy is perfect. At the end, it is all about doing things for the greater good.

In future posts, we will touch on how our Compass AE methodology diminishes the points that are stated from "The Strategy Paradox."

More to come.

Collaboration360 Consultants (C360). Copyright:2009 © All rights reserved

Copying, posting and reproduction in any form (without prior consent) is an infringement of copyright.

###

Timothy Geithner no superhero

KATHLEEN PENDER

Wednesday, February 11, 2009

The Senate overlooked Timothy Geithner's tax mistakes and confirmed him as Treasury secretary because he was the superhero who could rescue the financial system.

Turns out Geithner is a mere mortal. He has no magic bullets or secret decoder ring. And that explains why the stock market fell off a cliff as Geithner delivered his "Financial Stability Plan" on Tuesday.

By day's end, the Dow Jones industrial average had fallen 381.99 points, or 4.6 percent, to 7,888.88.

"I think the market is reacting to a growing sense that the problems are larger than the ability of our elected officials to deal with them," says Karl Mills, president of Oakland investment firm Jurika, Mills & Keifer.

Geithner laid out several new or expanded plans for relieving banks of their toxic assets and jump-starting lending. But all were short on specifics.

"People were expecting him to come up with something substantive. It was more of a progress report and a statement of the obvious," Mills says.

Geithner warned that his strategy will "require a substantial and sustained commitment of public resources" and will "involve risk and take time."

Kudos to Geithner for his honesty, but that is not what investors wanted to hear.

"The bottom line is, there is no easy solution," Mills says. "It's not like there's a death star you can load up with bad loans, shoot into space and 30 years later it will fall back to Earth."

Although Geithner is taking the blame for Tuesday's market tumble, President Obama did him no favors when he warned, in his televised news conference Monday night, that failure to pass a stimulus bill "could turn a crisis into a catastrophe."

"Those kind of comments set up (the idea) that this guy (Geithner) ought to have a good plan," says Steve Brown, president Pacific Coast Bankers' Bank in San Francisco. "Geithner came in and said I have a plan, but we're still working out the details, it's going to take a long time and cost a lot of money. That obviously doesn't give anyone the warm and fuzzies."

Adam Lerrick, an economics professor at Carnegie Mellon University, says Geithner failed to answer five questions, at least to Wall Street's satisfaction: "What is he trying to do? How is he going to do it? Why is it going to work? How much is it going to cost? Where is he going to get the money?"

Lerrick notes that Geithner's predecessor Henry Paulson didn't answer those questions, either.

Experts were especially disappointed at the lack of detail in Geithner's plan to help banks "cleanse their balance sheets" of "legacy assets" by creating a "public-private investment fund."

This fund would use public and private capital to buy toxic assets from banks. Private investors would set the price paid, thereby minimizing the cost and risk to taxpayers.

The problem is, if the fund buys these assets at a price private investors are willing to pay "it will bankrupt the sellers. If they pay more, they really jam it to the taxpayers," says Allan Meltzer, a professor of political economy at Carnegie Mellon.

The previous administration had the same problem with the $700 billion Troubled Asset Relief Plan. Originally, TARP was going to buy toxic assets from banks, but finding the right price was a big problem. If Treasury paid too much, it put taxpayers at risk. If it paid too little, it could erode bank capital.

Eventually, that's one reason Paulson decided to use the first part of TARP capital to buy preferred stock in banks. That helped shore up bank capital, but the toxic assets remain in banks.

Geithner's plan simply proves that "the problems are large, they are complicated and there is no easy answer," Mills says." If there was, somebody would have come up with it."

http://sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/02/11/BU1F15RN08.DTL

This article appeared on page C - 1 of the San Francisco Chronicle

Does Geithner's speech have anything regarding to "mission", "commitment", impact"; "reliability"; "consequences"; and "tangibility"?

Some people think his speech was high on philosophy and low on tangible specifics. In times of unpredictability, it is strategically better to keep the specifics a secret.

Mr. Geithner has a challenging job of fixing the economy. We at Collaboration360 wish Mr. Geithner and his team the best of all luck.

No comments:

Post a Comment