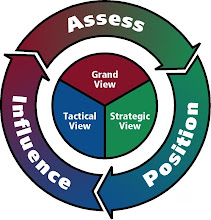

When one has the advantage of time and resources, there is no need to rush. Focus on detailed assessment, planning and preparation.

From the framework of 36 Stratagems

# 5. Loot a burning house (Chinese: 趁火打劫; pinyin: Chèn huǒ dǎ jié)

When a country is beset by internal conflicts, when disease and famine ravage the population, when corruption and crime are rampant, then it will be unable to deal with an outside threat. This is the time to attack.

Usage

Keep gathering internal information about an enemy. If the enemy is currently in its weakest state ever, attack it without mercy and totally destroy it to prevent future troubles.- Before the Battle of Gaixia, both Chu and Han forces were tired from a long lasting siege. After a peace treaty, the tired Chu troops began retreating out of Han territory. Han Xin and Zhang Liang both advised to Liu Bang :"We already control half of the empire. Even within Chu, many governors favour us being the ruler, and will not give Xiang Yu support unless forced to. The Chu troops are currently tired and face serious food stortages. The heavens have decided to end Xiang Yu 's power. If we let Xiang Yu escape, it will be like keeping a tiger alive only to kill its owner later. We must strike now and end this threat." After some thinking, Liu Bang gave the order to attack Xiang Yu, and eventually ended Chu.

#

Always assess the targeted party with a prepared strategic plan.

#

The Chinese are coming, to buy bargain US homes

By CHI-CHI ZHANG, Associated Press Writer

Thursday, February 12, 2009

(02-12) 08:35 PST BEIJING, China (AP) --

Beijing lawyer Ying Guohua is heading to the United States on a shopping trip, looking not for designer clothes or jewelry, but for a $1 million home in New York City or Los Angeles.

He expects to get a bargain. Ying is part of a growing number of Chinese who are joining tours organized especially for investors who want to take advantage of slumping U.S. real estate prices amid a financial crisis.

"It's a great time to buy because of the financial crisis, and houses in large cities like New York and Los Angeles will definitely go up in a few years," Ying said. The home is an investment, but he's also planning long-term: He hopes his 5-year-old son might use it if he goes to college in the United States.

While China's ultra-rich have been buying property in the U.S. for years, the buying tours are new, made attractive by still-rising Chinese income levels and American real estate prices that have been falling for two and a half years.

More than 100 Chinese buyers have joined such tours since late 2008, according to Chen Hang, the China-born vice president of real estate at Fortune Group. The Pittsburgh, Pennsylvania, company shows foreclosed commercial property to Chinese buyers.

"The Chinese are going to seize the opportunity to take advantage of some great deals," Chen said.

Ying, the Beijing lawyer, is one of 40 investors going to New York, California, Boston and Las Vegas on a Feb. 24-March 6 tour organized by Beijing-based SouFun Holdings Ltd., a real estate Web site. SouFun plans to show participants foreclosed properties priced at $300,000 to $800,000.

"We never thought these tours would garner such interest, but we've had an overwhelming response," said SouFun CEO Richard Dai. "Before, we heard of Chinese or Hong Kong movie stars buying homes in the U.S., and now more and more Chinese can afford to have the same."

The home-buying opportunities mirror a larger trend. Cash-rich Chinese companies are looking to buy resources made suddenly cheaper by the downturn or companies suffering under the global debt meltdown. On Thursday, the Aluminum Corp. of China, also known as Chinalco and the world's leading aluminum producer, invested $19.5 billion in debt-burdened global miner Rio Tinto Group — China's biggest overseas investment to date.

Because the authoritarian government has imposed controls limiting China's exposure to international capital flows, the country has largely avoided the worst of the global financial crisis. Meanwhile, high-level incomes have continued to rise. China had the world's fifth-largest population of millionaires in 2008 with 391,000, up 20 percent from the previous year, according to Boston Consulting Group.

But Chinese with money in the bank have few good investment options at home. Real estate prices have cooled and stock prices peaked in October 2007 after a two-year boom that saw shares rise six-fold in value. After years in which foreign money poured into China to take advantage of the hot economy, economists estimate that tens of billions of dollars began leaving the country in the last three months of 2008 as Chinese investors began bargain-hunting.

Chinese buyers are looking at both commercial property and homes to rent out or use on business trips. And the U.S. has plenty of unsold homes to offer — 3.67 million as of the end of December, according to the National Association of Realtors.

Many buyers are unfamiliar with U.S. markets, so they focus on well-known ethnic Chinese neighborhoods, according to John Wu, president of the Chinese American Real Estate Professionals Association in San Gabriel, Calif.

Lion's Property Development Group in New York City organizes Chinese groups to visit New York homes. The company also treats visitors to Broadway shows and famous restaurants in hopes that they will take to the city and buy a $1 million to $2.5 million home.

Trips are pricey. Ying, the lawyer, paid $2,200 — nearly the equivalent of the annual income for many Chinese — plus airfare.

Participants in a 10-day January tour organized by Beijing-based Environment International Travel Agency had to show proof of an annual income of at least $30,000 and that they owned a car and property in China.

A real estate developer from the southern city of Changsha said he spent $3,500 for the 10-day trip to view $500,000 to $1 million homes, and it worked.

He found a house in California's Silicon Valley that he planned to buy for his 20-year-old daughter, a university student in Boston who plans on attending graduate school in the Bay area.

"My daughter's monthly rent is $1,000, so it makes sense to buy a place, because I'm getting a return rather than throwing money away," said the developer. He would talk on condition that he be identified only by his surname, Zeng.

The price of the house, he said, was $1 million, compared with $1.3 million before the crisis in early 2007.

"The price is low now, but it's in a good neighborhood with breathtaking views, so it will definitely appreciate," he said.

___

On the Net:

Environment International Travel Group: www.youhulu.com (in Chinese)

Lion's Property Development Group: www.lionspd.com/

SouFun Holdings Ltd.: www.soufun.com/

___

Associated Press business writer Joe McDonald contributed to this report.

http://sfgate.com/cgi-bin/

No comments:

Post a Comment