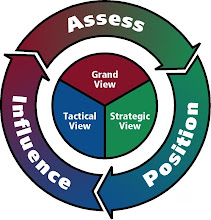

Assessing the potential alliances and the opposition through the use of Sunzi principles is quite simple.

Assessing the potential alliances and the opposition through the use of Sunzi principles is quite simple.

Gathering "complete" intelligence on the contenders (not the pretenders) is the first step.

The next step is assessing the intelligence in terms of the "Public View", "The Functional View", The Field View", The Organizational View" and the "Definite View

While analyzing their past history and current actions from those different views can be quite taxing, transforming the intelligence into a top-down plan is the greater challenge.

If you like to know how to transform assessed data into a top down strategic view, please contact us at service [att] collaboration360 [dott] com.

If you like to know how to transform assessed data into a top down strategic view, please contact us at service [att] collaboration360 [dott] com. #

Everyone's on hand

It was pretty stuffy at Wednesday's news conference introducing incoming Police Chief George Gascon -- maybe it was all the egos in the room.Apparently no one wanted to be left out: City officials nearly outnumbered members of the media at the packed event in the mayor's office. And we couldn't help but notice that most of those elected officials -- some of whom have traded harsh words lately -- have their sights set on higher office.Of course, Mayor Gavin Newsom is looking to move to Sacramento, and numerous people in attendance are thought to be angling to replace him: Supervisors Ross Mirkarimi and Bevan Dufty, City Attorney Dennis Herrera and Assessor Recorder Phil Ting (who shares a political consultant with Newsom and got a special shout-out towards the end from the mayor).

Michael Macor

The Chronicle Incoming Police Chief George Gascon

gets a warm welcome from the whole city family Wednesday.

But ambition doesn't stop at San Francisco's borders: Attorney General candidate and current District Attorney Kamala Harris was front and center. And her right hand man, Chief Assistant District Attorney Russ Giuntini (who may be looking to become the city's top prosecutor) was also there.Also in attendance were Board President David Chiu, supervisors Carmen Chu, John Avalos, Eric Mar and David Campos, Public Defender Jeff Adachi (who's gearing up for a budget fight).

Appointed officials were on hand too, including Fire Chief Joanne Hayes-White, Police Commission President Theresa Sparks, Police Commissioner David Onek, Bill Siffermann, San Francisco's juvenile probation chief and Kevin Ryan, director of the Mayor's Office of Criminal Justice.

And, of course, Police Officer's Association president Gary Delagnes, who never fails to give a great quote. Case in point-- when Delagnes was asked what challenges Gascon will face, he had this gem: "Politics. San Francisco (is) unlike Los Angeles or any other city in America. To learn the players on the police commission, to learn the players on the board of supervisors, the mayors office, the command staff, the media," Delagnes said. "He's got to see where the knives are coming from and the knives are coming from day one. They already started today."Posted By: Marisa Lagos (Email) | June 17 2009 at 03:30 PM

http://www.sfgate.com/cgi-bin/blogs/cityinsider/detail?blogid=55&entry_id=41905

http://www.sfgate.com/cgi-bin/blogs/cityinsider/detail?entry_id=41905