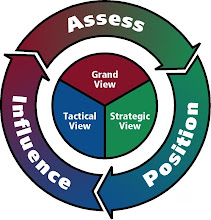

When assessing one's marketplace, focus on understanding what are the current and future economic influences and the current state of the marketplace.

At this moment, businesses of all sizes must decide what is the next big trend for their marketplace. They are in process of assessing their grand picture, searching for the grand variable that indicates the economy is turning around.

Historically, the smaller companies usually pursue the "high risk, high reward" ventures while the larger companies sit and wait for the smaller companies to validate the new marketplace and create internal mistakes at the same time .

Conclusively, the process of strategic assessment always plays the important role in understanding what are the current and the future opportunities, especially for those who are willing to pursue the apex position of their marketplace.

So, what is the dilemma? Deciding on when to stop assessing and start the planning and preparation process. We will touch more on this topic later on.

#

No rebound just yet, according to supply-chain survey

By Peter Clarke

EE Times Europe

(05/06/09, 08:33:00 AM EDT)

LONDON — The electronics supply chain remains pessimistic and appears to believe we have not yet seen the bottom of the recession, according to a survey of more than 230 electronics supply chain decision makers.

Respondents gave an average score of 4.2 regarding how the current economic situation is impacting their company on a scale of 1 to 10, 1 being "very negative" and 10 being "very positive."

When asked about the next 6 months, these same respondents answered with an average score of 4.6, a small, but significant increase, pointing to a belief that the business environment in the technology sector will improve. Respondents were also neutral (average score of 4.9) regarding prospects for their company's profits for the next 6 months.

Respondents that identified themselves as electronics manufacturing services (EMS) or original design manufacturing (ODM) companies were generally more optimistic at 5.4. Respondents from semiconductor, distribution and logistics, and components manufacturing firms were more pessimistic, giving average scores of 4.2, 4.0, and 3.4 respectively. The survey was conducted by VentureOutsource.com and sponsored by electronic component distributor Digi-Key.

"VentureOutsource.com's survey is revealing and confirms what we're seeing," said Paul Singh, CEO for privately-held Suntron Corp. a North American EMS provider serving such end-markets as military/aerospace and industrial and medical electronics. "Economic conditions are impacting the industry as a whole, but quality-focused companies not burdened by a lot of debt and with good cash flow should emerge okay once economic conditions improve," added Singh.

"Our findings don't indicate a full recovery in the electronics sector is underway just yet but our survey results do provide some helpful information indicating where we are right now in this downturn," said Mark Zetter, president and founder of VentureOutsource.com.

Related links and articles:

Intersil and Digi-Key sign distribution agreement

When the going gets tough, the tough get trained

http://www.embedded.com/217300436?cid=NL_embedded#

If you are interested in understanding the basics of assessing a marketing terrain, please view this past post .

No comments:

Post a Comment