Bilateral trust can only go so far.

Always perform due diligence. Assess the other party before and during the dealing process.

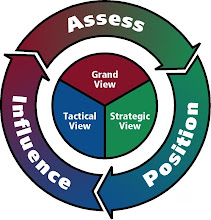

What is the strategic process?

Assess him or her in terms of the competitive positioning of both parties, the competitive advantage of both parties, the weaknesses and strengths of the parties, etc.

Compare and contrast each parties with the rest of the competition.

Those who do not assess properly, might face the consequences of failure.

After the assessment is completed, he/she asks the following question, "What is my competitive position now?"

#

February 8, 2009

For Bank of America and Merrill, Love Was Blind

By LOUISE STORY and JULIE CRESWELL IN mid-September, as Wall Street unwound and venerable financial institutions were brought to their knees, the mood inside the Manhattan law offices of Wachtell, Lipton, Rosen & Katz was decidedly celebratory.

After a weekend of whirlwind deal-making and emergency meetings at the Federal Reserve Bank of New York, John A. Thain and his team at Merrill Lynch had sold their troubled brokerage firm to the Bank of America Corporation, dodging the financial sinkhole that was swallowing Lehman Brothers.

But before Wachtell lawyers, who were representing Bank of America, signed off on the deal, they told Merrill’s lawyers that they wanted to be sure about just one more thing: the size of the bonuses that Mr. Thain and his colleagues would snare at the end of the year. A page was ripped from a notebook, and someone on Merrill’s team scribbled eight-digit figures for each of Merrill’s top five executives, including $40 million for Mr. Thain alone.

Although Merrill had been bleeding money all year and would continue to do so the bonuses weren’t, as Merrill executives later explained to colleagues, about that performance. Rather, they were fees for getting the merger done, akin to what investment bankers receive for blockbuster deals.

Mr. Thain in particular felt he deserved a hefty payout for his deal-making heroics, according to five individuals with detailed knowledge of the situation who requested anonymity because of their personal and business relationships with those involved.

A few weeks later, Merrill’s human resources director visited John D. Finnegan, the head of the compensation committee on Merrill’s board, and told him about the bonuses, according to four people briefed on the conversation. “That’s ludicrous,” said Mr. Finnegan, the chief executive of the Chubb Group of Insurance Companies. He thought that the lush bonus requests came across as greedy and insensitive particularly because Wall Street was in such dire straits that it was likely taxpayer support would be needed to survive.

An internal debate with Mr. Thain over his bonus ensued; a person familiar with Mr. Thain’s thinking said that a $40 million bonus was “never a subject of serious discussion.”

Even so, others at Merrill were put off by his bonus negotiations, which helped splinter the carefully tended image of Merrill’s chief executive, a man perceived during most of his career to be a robotic and circumspect number-cruncher.

More important, the episode revealed the rampant hubris and sense of entitlement embedded on Wall Street, foreshadowing the myriad problems that would eventually threaten the merger of the two beleaguered financial giants. Hailed as the path forward for a Wall Street in disarray, the merger offered Merrill a chance to rebound from billions of dollars in mortgage-related mistakes and gave Bank of America access to Merrill’s well-known brand and its vast network of brokers, known as the thundering herd.

But the merger, in which Bank of America agreed to pay about $50 billion in stock for Merrill, soured at light speed. Back then, the combined companies would have been valued by the stock market at about $176 billion.

Today, the combination has a market capitalization of only $39 billion. Interviews with almost 30 current and former Bank of America and Merrill executives and employees convey just how messy the merger has been. All of them asked not to be identified because they either did not have permission from the banks to speak or because they had signed confidentiality agreements with their former employers.

On one side is Mr. Thain, who was viewed as someone who promised far more to Merrill than he delivered. Although he has repeatedly said that he helped heal the firm’s financial wounds and its battered morale, he wound up insulating himself from most top Merrill executives and failed to protect the firm from a stunning $15.3 billion loss in the fourth quarter of last year, according to several current and former senior Merrill insiders.

On the other side of the deal is Kenneth D. Lewis, a pragmatic, no-nonsense banker who, as Bank of America’s chief executive, monitored the Merrill takeover from a remote base in his Charlotte, N.C., headquarters and who, according to people at his bank, was perhaps blinded to Merrill’s risks by his own ambitions and penchant for empire building.

While Mr. Lewis has maintained in calls with analysts that his team dug deep into Merrill’s books in mid-September, analysts have repeatedly questioned whether the reviews were thorough. Although Mr. Lewis contends that he was surprised by the magnitude of Merrill’s losses, his financial team on the ground in New York had daily access to Merrill’s trading books, which would have allowed them to detect the mounting exposures. Spokesmen for Mr. Thain and Mr. Lewis declined to comment for this article.

Now, after dismissing Mr. Thain amid public criticism about his bonus negotiations and the huge losses, Mr. Lewis faces an uphill battle as he struggles to make the marriage of two financial giants work. Taxpayers are furious that Bank of America hit up the government for a second round of bailout funds in order to close the Merrill deal earlier this year, bringing its tab at the federal trough to $45 billion and potentially exposing taxpayers to further losses.

Shareholders were shocked to see the stock of what was a solid retail banking operation recently trade below $5 a share. And Bank of America employees are angry that their own bonuses have all but evaporated because of what they see as Mr. Lewis’s mistakes. While Bank of America’s board has affirmed its support for Mr. Lewis, 61, many analysts believe that his job and his own legacy is in jeopardy if the ambitious bet he placed on Merrill plays out poorly.

Mr. Lewis is now scrambling to shore up his bank and its image by conserving cash and selling corporate jets. The bank, meanwhile, is providing reams of documents to the New York attorney general, who is investigating whether all aspects of the Merrill merger were handled legitimately.

Above all, individuals inside the bank say, Mr. Lewis is desperate to avoid greater government intervention and maintain control over his wobbling financial empire. “When you go into a deal, you hope for the best but expect the worst,” says Nancy Bush, a banking analyst. “I think Bank of America did plenty of due diligence; they just ignored what they found. They knew it was there. They just didn’t completely grapple with the fact that it could get uglier. And it did.”

ON Jan. 22, only shortly after the Merrill takeover was formally complete, breaking news drew Bank of America’s traders away from their blinking computer screens in New York to nearby televisions: John Thain was out. Spontaneous applause broke out across the trading floor and bets were placed on which one of Mr. Thain’s highly paid lieutenants would be next. That reaction was hardly a surprise.

In the eyes of Bank of America employees, Mr. Thain sold them a lemon of a company that put their own company and their jobs at risk. The animosity was fueled by reports of Mr. Thain’s lavish $1.2 million office renovation and last-minute bonuses that he paid out to Merrill employees days before the deal closed. A manager at Bank of America said that he and others were ordered to cut already-low bonuses by 20 percent the day after Merrill’s loss became public. A Bank of America spokesman said the bank did not tie its bonuses to Merrill’s results.

What is a surprise, however, is just how disliked Mr. Thain, 53, had become inside Merrill. When he arrived at Merrill in late 2007, he was given a hero’s welcome.

Mr. Thain, lanky and square-jawed at 53, was brought in to fix the wayward firm battered by losses and the ouster of its controversial leader, E. Stanley O’Neal. Merrill’s board thought Mr. Thain perfect for the job. He had traded mortgage securities at Goldman Sachs in the 1980s and rose quickly through that investment bank’s ranks to become one of the youngest chief financial officers on Wall Street. He left Goldman in 2003 to lead the New York Stock Exchange, in part because Goldman had passed him over for the top job there.

Ultimately, Mr. Thain’s tenure at Merrill would generate distinctly different internal assessments of his character within the firm. Initially, people considered him aloof but hard-working and well intentioned. After he helped engineer the sale to Bank of America at a moment when Lehman was collapsing, he was regarded as a savvy deal maker who saved the firm.

But after publicity about his lavish office redecoration and his bonus negotiations was coupled with the firm’s huge losses, people came to resent what they considered to be his feckless and self-aggrandizing behavior.

When he was first ensconced at Merrill, he brought over his closest associates from the Big Board, including Margaret D. Tutwiler to run communications. A seasoned political operator who spent most of her career working for Republican administrations in Washington, Ms. Tutwiler largely spent her time cultivating Mr. Thain’s image. Ms. Tutwiler quickly scheduled a series of interviews for Mr. Thain from Merrill’s trading floor.

As the cameras flashed, he shook hands with the troops. When the cameras left, so did Mr. Thain. “He went on a series of speeches all over the world. He was being called a hero. The press was incredible,” remarked one Merrill Lynch executive. “What was not happening was that he was not meeting with Merrill people.”

Mr. Thain, who always carefully parses his public comments and is a well-known micromanager, seemed to insulate himself from longtime Merrill executives and didn’t take time to familiarize them with his plans for reviving the firm. Instead, he surrounded himself with former colleagues. In addition to luring his N.Y.S.E. deputies, he showered cash on former Goldman executives to bring them to Merrill. He paid $25 million to Peter S. Kraus, who ran Goldman’s investment management unit, to oversee business strategy at Merrill. He shelled out $39 million to Thomas K. Montag, who was co-head of Goldman’s global securities unit, to run Merrill’s trading operations.

Mr. Kraus and Mr. Montag have already received all of that money, some in cash and some in stock and options.

Mr. Kraus, who was not offered a job at Bank of America, left Merrill weeks later to become C.E.O. of AllianceBernstein. Mr. Montag, who is still at Merrill, declined to comment on his compensation, as did Mr. Kraus. Mr. Thain took control of Merrill’s gigantic trading and risk-management operations, saying that his mortgage expertise would help him solve the firm’s problems. He also quickly raised capital $12.8 billion by early 2008. Enough, he repeatedly told Wall Street analysts, to cover the firm for the year. Along the way, Ms. Tutwiler helped get out the message:

Mr. Thain was cleaning house and getting rid of Mr. O’Neal’s problems. But on the ground at Merrill, gridlock ensued. For months, there were inquiries from hedge funds and other buyers about a range of mortgage assets and securities, but Merrill’s mortgage desk was blocked from distributing price lists because Merrill’s management refused to agree on market estimates, according to Merrill insiders.

By last summer, these people say, Mr. Thain began to realize that he, in fact, didn’t have a handle on Merrill’s mortgage mess. When he learned the firm’s second-quarter earnings were devastated by mortgage losses, he picked up a chair and threw it against a wall, according to two people who were briefed on the incident.

On a conference call shortly after that, he was testy with an analyst who asked about Merrill’s toxic portfolio of securities known as collateralized debt obligations, or C.D.O.’s: “I did not create these C.D.O.’s,” he said.

After Mr. Thain decided to sell a batch of Merrill’s C.D.O.’s at a cut-rate price, he had to raise more capital. That incurred a fee with certain Merrill investors, forcing the firm to pay them $4.6 billion. On top of that, Mr. Thain’s point man for the C.D.O. sales alienated a potential buyer, Guggenheim Partners, that had been willing to pay north of $2 billion more in cash than Merrill received, driving yet more cash out the door just when investor confidence in Wall Street was about to nose-dive all of which eventually pushed Mr. Thain into Bank of America’s arms.

IN New York on Monday, Sept. 15, after that weekend of meetings at the New York Fed, Mr. Thain and Mr. Lewis shook hands for photographers as they announced the merger. Mr. Thain emphasized his successes at Merrill, saying that “we have been consistently cleaning up the balance sheet, repairing the damage that was done over the last few years.” Mr. Lewis had built Bank of America into one of the nation’s largest and most powerful banks through numerous mergers. Some acquisitions like Merrill and, earlier, Countrywide Financial were riskier than others. He felt strongly that Merrill’s brokers, tied to his bank’s retail branches, would increase his bank’s ability to sell its products. That included his firm’s own stock.

When Bank of America raised $10 billion in new capital just a few weeks after announcing the merger with Merrill, Mr. Lewis got on a conference call with Merrill’s financial advisers and encouraged them to sell his bank’s stock to their clients. It wasn’t the most propitious time to be pushing a bank stock: a week later, the government pumped $125 billion into nine large banks, including Bank of America. Mr. Thain, meanwhile, was already in the running for other jobs. He was rumored to be Senator John McCain’s choice for Treasury secretary. When Senator McCain lost the presidential election, Mr. Thain still had a nice option: possibly taking the reins at Bank of America when Mr. Lewis retired. New trouble, however, was brewing on Merrill’s trading floor. Under Mr. Montag’s direction, Merrill’s traders were far more active than they had been since Mr. Thain’s arrival. Said by Merrill insiders to be an unpopular figure, Mr. Montag further alienated many people already stunned by the $39 million package Mr. Thain gave him when he insisted on a holiday before starting at Merrill. His late arrival, many individuals at Merrill say, left traders navigating troubled markets on their own and uncertain about when their boss would arrive to guide them. Mr. Montag has little interaction with traders on the floor, largely communicating through short, sometimes castigating, e-mail bursts, according to Merrill insiders. Others say that when a Merrill trader or colleague disagrees with him,

Mr. Montag like Mr. Thain often points out that he didn’t create the financial mess at Merrill. Last October, Mr. Montag’s traders dove into higher-quality, though risky, mortgage assets known as alt-A loans, according to people familiar with Merrill’s trading books. The fate of those maneuvers is now hotly disputed inside and outside of Merrill. Several individuals familiar with the alt-A trades, as well as others involving bets on such things as interest rates and equity derivatives, say that these gambits contributed about a third of the firm’s $15.3 billion fourth-quarter loss. But a senior Merrill trader and a former senior Merrill executive contend that there were no “significant” trading losses taken in the quarter. The former executive said that any investigation of the firm’s trading would support that fact. Whatever transpired on the trading desk, Merrill was still contending with withering assets that predated Mr. Thain’s arrival. Despite the fact that Mr. Thain inherited these assets, Merrill insiders say they could have been hedged moves well within Mr. Thain’s purview as head of risk management at the firm. Yet he never did so, according to three people who worked closely with him. An individual familiar with Mr. Thain’s thinking said that Mr. Thain didn’t believe hedges would have been effective. Losses in those so-called legacy assets would reach $10 billion in the quarter. By most accounts, few at Merrill knew how much the fourth-quarter losses would be. Many chalk that up to the fact that Mr. Montag reported directly to Mr. Thain, bypassing other Merrill executives. Still, other individuals inside Merrill note that Bank of America, shortly after the deal was announced, quickly put 200 people at the investment bank, including a large financial team. A Bank of America executive was sent to New York from Charlotte to act as an interim chief financial officer and had daily access to Merrill’s profit-and-loss statements.

Likewise, Bank of America was well aware of the $3.2 billion in bonuses that Merrill paid to its rank and file in late December. The two companies had agreed in September that Merrill might pay up to $5.8 billion, according to a private agreement reviewed by The New York Times. Several weeks after that agreement was struck, a top deputy to Mr. Lewis met with Mr. Thain and asked him to lower the bonus pool below $3.5 billion and to increase the portion paid in cash. Mr. Thain agreed to do so, according to two people familiar with the meeting.

Mr. Thain, meanwhile, lobbied for a bonus of his own until December, according to people familiar with his board discussions. The initial $40 million suggestion floated on his behalf was no longer viable and Mr. Thain himself suggested a figure of $5 million to $10 million. After that number was pilloried in public, he formally asked the board to award him nothing. On Dec. 9, Mr. Thain flew to Charlotte to attend Bank of America’s board meeting, where Merrill’s financial results through November were presented. Already 60 percent of Merrill’s losses were visible, but neither Mr. Lewis nor his board questioned Mr. Thain about the losses, according to a person close to Mr. Thain. Mr. Lewis did not immediately disclose the losses to his shareholders, who had voted to approve the merger just days before. Mr. Lewis later said that the losses greatly accelerated in mid-December, which caught him off guard.

On Friday, James Mahoney, a Bank of America spokesman said that “we have not disputed that we were kept informed about the financial condition of the company.” During the last two weeks of December, while Mr. Thain was skiing in Vail, Mr. Lewis told federal regulators that he was thinking of backing out of the deal because of the losses. Government officials, according to Mr. Lewis, told him he had to complete the deal in order to keep markets calm. But Mr. Lewis did not tell Mr. Thain about his talks with the government until Jan. 5, according to a person close to Mr. Thain.

AS the merger closed, and a new year began, Mr. Thain was prepared to take on a leadership role at Bank of America, even though several of his top deputies, longtime Merrill leaders, began leaving the bank themselves. Mr. Lewis, battered by analyst questions about the wisdom of the Merrill takeover, became disenchanted with Mr. Thain. In mid-January, he met with Mr. Thain at Merrill’s downtown headquarters. After a five-minute meeting, Mr. Thain was out. Furious, Mr. Thain paced the halls of Merrill, venting his frustration to at least two people. “I don’t know how these people can run this company without me,” he told them.

Copyright 2009 The New York Times Company

http://www.nytimes.com/2009/02/08/business/08split.html

No comments:

Post a Comment